Marirangwe United Bush Dairy Smallholder Farmer Initiative

Smallholder farmers signing up for their shares in the MYUBD Cooperative

The Marirangwe United Bush Dairy (MUBD) is a private smallholder dairy cooperative operating in the Marirangwe area. Noting the little participation of smallholder farmers from the surrounding communal farming sector in the dairy initiative ZADT with support from the Dan Church Aid facilitated entry of the communal farmers into the cooperative through purchase of shares. Access to finance to purchase shares by the smallholder farmers was partly through a grant from Dan Church Aid and a loan from ZADT. Identification, registration and capacitation of interested farmers from Monera and Dzumbunu communal areas was done in partnership with the Farmers Association of Community self-Help Investment Groups (FACHIG), a non-governmental organization who operate in the area. The smallholder farmer shareholders are now receiving dividends from the Cooperative and are servicing their loan obligations through the earnings.

Impact of ZADT Fund on borrowing agribusinesses

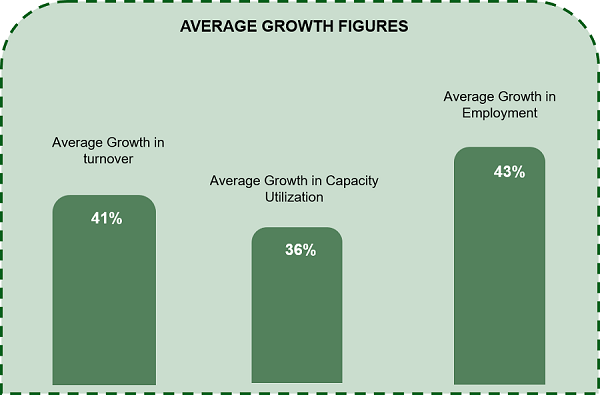

An assessment was done to establish the impact of the ZADT Fund on the performance of funded agribusinesses. The assessment focussed on the extent to which the Fund contributed to changes in three main indicators namely annual turnover, capacity utilization and employment levels. The changes in the parameters were measured between the period when the facility was disbursed and when it matured. The findings are presented in the Figure below.

Summarized findings

Agribusinesses with facilities maturing in 2018 had an overall turnover growth of 41%. There were no sampled agribusinesses with an average growth in turnover of less than 10%. All of these companies admitted that the ZADT Fund contributed to more than 50% of total funds supporting their operations during the year. The ZADT Fund therefore contributed to the growth in the turnover of these businesses. The Fund was also able to contribute positively to the productive capacity of borrowing agribusinesses. The overall contribution of the Fund to increased capacity utilization was 36%. There were two companies who recorded 100% growth in capacity utilization indicating full impact of the Fund on the businesses.

In line with increased capacity utilization, agribusinesses recorded a 43% overall increase in employment levels. The boost in capacity utilization increased their ability to produce more hence the need for additional human resources. The ZADT Fund therefore contributed to employment creation specifically to the funded businesses and to the country as a whole.

Impact of ZADT Fund on farmers’ agricultural production, asset accumulation, income, food and nutritional security

Highlights from the Second phase of the Round 2 longitudinal sentinel study are presented in this section. The Sentinel study is an impact assessment conducted in order to measure the effect of the Fund on farmer’s agricultural production, asset accumulation, income, food and nutritional security. Information was collected from households involved in different value chains which were being supported by borrowers of the ZADT Fund. The study results show that the program was successful in improving the welfare and income of farmers.

Improved access to credit

The ZADT Fund improved smallholder farmer’s access to credit, particularly for women. Approximately 52% and 44% of the farmers that obtained ZADT credit mostly in kind through the funded VCAs were females in 2016/17 and 2017/18 season respectively. The national Gender policy advocates for a 50% participation between men and women. Results also showed that farmers have limited access to credit from other sources confirming the importance of the ZADT facility to smallholder farmers.

Improved access to extension

Farmers that participated in programmes financed by the ZADT Fund had better access to extension services. In addition to government extension support services that are provided to all farmers, about 42% and 43% of farmers that participated in the ZADT funded programme in 2016/17 and 2017/18 obtained additional extension support from borrowers respectively. In the ZIMVAC report the proportion of households that received extension visits actually declined from 31% in 2016/17 to 21% in the 2017/2018 season. The trend shows that household visits are becoming less frequent. Availing extension support helps in building capacity among farmers and also improves productivity. This has spill over effects towards household welfare and economic development.

Contribution of ZADT Fund to smallholder farmers’ incomes and market access

The ZADT funded programme was instrumental in creating a stable, viable and guaranteed market for smallholder farmers in the two cropping seasons. ZADT funded value chain actors contributed 58% to total farmers’ crop revenue generated in 2016/17 season. Income obtained through the borrower accounted for a greater proportion of income that was obtained from all crops sales.

Contribution of ZADT Fund to food security and livelihoods

Income obtained by farmers supported by ZADT funded agribusinesses had positive effects on dietary diversity and food consumption. Most of the income generated from crop sales under the ZADT facility in 2016/17 (36%) and 2017/18 (28%) was used to purchase food and subsequently improved dietary diversity. Regression analysis results showed that a unit increase in the initial credit led to a 2.4% and 3.7% increase in household dietary diversity and food consumption score respectively in 2016/17. In 2017/18, credit access increased household dietary diversity and food consumption score by 13% and 10% respectively. Some of the farmers used the income to pay for their children’s education. This had a positive and long-term effect on human capital development. Farmers also reinvested their income into agricultural activities (20%) and (18%) for 2016/17 and 2017/18 seasons respectively. The ability to reinvest ensures sustainability of farm enterprises. These results are in line with Sustainable Development Goal (SDG) 2 of ending hunger, achieve food security and improved nutrition and promote sustainable agriculture.

Sustainability of the established agribusiness links

Despite the fact that some of the facilities had matured at the time of the study, a borrower in the (banana value chain) maintained links with farmers. Tea farmers who were linked to a borrower whose operations were closed re-established their links with the parent company. This demonstrates that farmers have been capacitated to forge their own partnerships, a key indication of sustainability. The duration of relationship with borrower had a positive and significant correlation with crop income for sugarcane and Michigan pea farmers. An additional year of borrower-farmer relationship increased income among sugarcane and Michigan pea farmers by 15% and 45% respectively. Therefore, nurturing and promoting long-term relationships between credit providers and farmers is important to enhance household welfare.

Recommendations

The study findings indicated that the ZADT facility had a positive impact on improving agricultural productivity, incomes, livelihoods and food security of smallholder farmers. Given these positive contributions the facility needs to continue availing the credit to farmers.

Crops and commodities where smallholder farmers have benefitted

Some examples of crops and commodities where smallholder farmers have benefitted from linkages with funded agribusinesses are as follows:

Livestock Production

Beef Production

Thousands of smallholder farmers have benefitted from Agribusinesses and Micro Finance Institutions funded under the ZADT Fund. Range of benefits under beef production include;

- Markets provided for their cattle through several funded companies operating in Goromonzi, Gweru, Masvingo, Insiza, Nkayi and Mbire Districts.

- Smallholder farmers have also received livestock production and management lessons through these funded agribusinesses.

- Micro loans for pen fattening through funded Micro Finance Institutions.

* Beef production in Plumtree

Poultry

Several actors in the poultry industry have accessed the ZADT Fund. These have benefitted over 50,000 smallholder farmers in various parts of the country. Actors such as Feed Manufacturers, Chicken producers, Chick suppliers and producers themselves have accessed the ZADT Fund since 2012 to date.

Nature of benefits for smallholder farmers through these borrowing actors are as follows;

- Access to poultry chicks distributed across all rural areas of Zimbabwe.

- Access to stock feeds and related chemicals.

- Contract arrangements for broiler production

- Micro loans for broiler and egg production through funded Micro Finance Institutions.

- Provision of free training services four times a year on broiler management and stock feeds use and management.

* Broiler production by a small scale farmer in Chegutu

Piggery

The ZADT Fund has benefitted smallholder farmers engaged in piggery production in various communal areas including Gokwe. Most of these farmers were funded with microloans for their projects by Microfinance institutions participating under the ZADT Fund.

One of the farmers Mr. Munyariwa mentioned that he accessed a working capital loan to purchase stock feed for the piggery. He expressed his gratefulness for the loans offered under the ZADT Fund as they allowed his family to engage in various agricultural activities which in turn availed him opportunities to fend for his family.

* Piggery project in Gokwe

Cereal Production

Sorghum

ZADT has supported sorghum production in Chiredzi, Binga and Mbire. This has been achieved through agribusinesses accessing ZADT Working Capital facilities to finance contract farming inputs and sorghum grain purchases from smallholder farmers. One of the clients was a Mahewu (non-alcoholic beverage) brewing company who used sorghum as input in their plant. Smallholder farmers have also benefitted from Traders accessing the ZADT Fund to avail a ready market of sorghum thus reducing travelling costs.

One of the farmers in Chiredzi, Mr Nyathi noted that they used to face challenges with accessing inputs, transportation for their produce and access to packaging materials which the ZADT client now provided for free.

Due to the favourable contractual arrangements for sorghum production, the Nyathi family had managed to improve their lives and enjoyed the following achievements; purchased a 10 tonne Nissan UDI Truck, built a proper homestead for his family and purchased a tractor drawn cultivator.

* A flourishing Sorghum crop in Chiredzi

Maize Production

Smallholder farmers have benefitted from contracting companies for maize production. Farmer groups have also accessed direct loans from Banks and Microfinance Institutions under the ZADT Fund.

One community project operating in Murehwa and Makoni benefitted from direct lending from CBZ Bank. 5,000 smallholder farmers were organized into groups and funded for inputs into maize production under conservation farming method. Farmers were also provided with technical backstopping and marketing arrangements of the produce under the project.

In another project funded by ZADT, more than 1,000 farmers were supported to grow maize in Chiweshe, Goromonzi and Zvimba under contract arrangements. The company supplied inputs for up to 1 hectare per farmer. The inputs included seeds, basal and top-dressing fertilizer, herbicides and insecticides. Farmers would pay for the inputs after harvesting and marketing of the produce. Inputs for one hectare of maize were repayable by two tonnes of maize.

* Maize crop under irrigation in Chiredzi

Pulses

Mung Beans

ZADT funded an agribusiness that was into contract farming and training of smallholder farmers in mung bean production. Over 500 smallholder farmers benefitted through access to inputs, access to viable market and extension services for mung bean production. The company provided farmers with a variety of products ranging from seed, chemicals, fertilizers, irrigation equipment, tunnels, spray equipment and this enabled the farmers to achieve top commercial yields in the supported cropping season.

* A flourishing crop of Mung Beans

Michigan Pea Beans

Farmers in Manicaland Province, Zimbabwe were supported to grow Michigan Pea Beans by a food processor borrowing from ZADT Fund. The borrower provided inputs in the form of seed to Michigan Pea Bean farmers. The borrower also facilitated agreements with Micro Finance Institutions who provided fertilizers and herbicides on credit to all contracted smallholder farmers for repayment at harvest.

Farmers also enjoyed a viable market for their Michigan Pea Bean produce. Smallholder farmers also benefitted from technical assistance offered by the borrower through the company’s agronomists.

* Michigan Pea bean field supported by ZADT Borrower in Masvingo.

Vegetables

Paprika

Over 100 small holder farmers were contracted by a ZADT Fund borrower to grow paprika in Hurungwe, Mberengwa and Mutambara communal areas.

Oil Bearing Crops

Sesame

More than 5,000 smallholder farmers from different parts of the country have ventured into Sesame production where agribusinesses have established off-take agreements.

* A smallholder farmer and his wife pose in front of their Sesame crop during a field day in Chiredzi in April 2015

Sugar Crops

Sugar Cane

In the Lowveld, close to 900 smallholder farmers have ventured into sugarcane production as out growers for Hippo Valley.

A young smallholder sugarcane grower in the Mkwasine Estate. He grows sugarcane on a 11.4 hectare plot.

Fruits

Banana Production

About 1,000 smallholder farmers in Mutasa and Chipinge districts have entered into contract production of bananas for ZADT borrowing companies . More and more companies are buying bananas from these areas.

* A woman watering yams in front of their family banana crop in Honde Valley

Passion Fruit

About 1000 smallholder farmers with access to water resources are engaging in production of horticultural crops such as fruits for sale to food processors who have accessed the ZADT Fund through disbursing financial institutions.

* A granadilla plot in Domboshawa grown by a smallholder farmer. The fruit is supplied to a food processor borrowing from the ZADT Fund.

Other Field Crops

Tea Production

More than 1500 smallholder farmers in Honde and Save Valleys have established tea plots in out grower arrangements with tea companies borrowing from the ZADT Fund. These companies have accessed value chain financing under the ZADT Fund for working capital purposes which has enabled them to provide inputs and buy the harvested produce from the contracted farmers under off-take arrangements.

* Tea plot in Honde Valley

For Impact stories on video click on this link